The Bullish Case for Zcash

Zcash is a decentralized cryptocurrency that shares many properties with Bitcoin. They are both distributed and trustless networks that enable secure, peer-to-peer online transactions while following an economic model of a 21,000,000 unit limit with an emission rate that halves every 4 years. The main difference, albeit far from the only one, is that Zcash supports fully private, untraceable transactions. While Bitcoin’s openness broadcasts and records eternally transactions that are linkable to your identity, Zcash allows users to keep their affairs private.

Zcash is a decentralized cryptocurrency that shares many properties with Bitcoin. They are both distributed and trustless networks that enable secure, peer-to-peer online transactions while following an economic model of a 21,000,000 unit limit with an emission rate that halves every 4 years. The main difference, albeit far from the only one, is that Zcash supports fully private, untraceable transactions. While Bitcoin’s openness broadcasts and records eternally transactions that are linkable to your identity, Zcash allows users to keep their affairs private.

Zcash’s Privacy

In August 2010, Satoshi Nakamoto, the anonymous creator of Bitcoin, stated, “If a solution was found, a much better, easier, and more convenient implementation of Bitcoin would be possible” in response to a question about using zero-knowledge proofs to enhance Bitcoin’s privacy. These zero-knowledge proofs were explored in a research initiative known as Zerocash, which began in 2013 and ultimately led to the launch of Zcash in 2016.

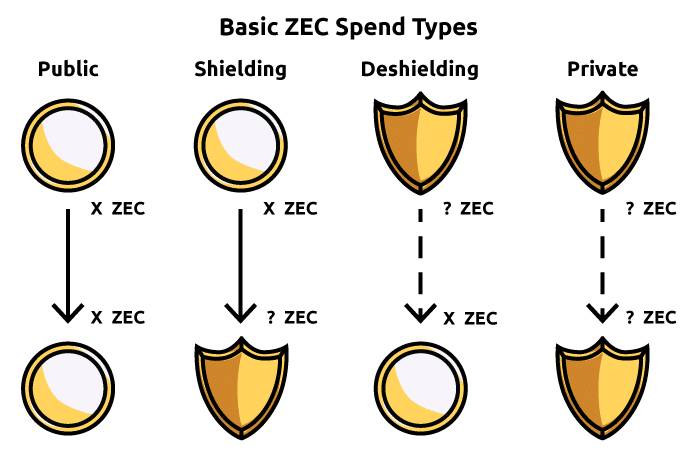

Zcash implements two types of transactions and addresses, allowing its user to choose the one appropriate for the moment:

- Transparent: These are the same as Bitcoin’s. The blockchain records visibly all addresses and amounts involved in the transaction.

- Shielded: These transactions are registered on the blockchain with no traces of the addresses or amounts involved.

Users can also share “viewing keys” if they want to selectively disclose the contents of a shielded transaction to a party, such as a company, that wishes to provide evidence to a regulator.

Many people mistakenly believe that Bitcoin payments are anonymous simply because pseudonymous addresses are used. However, the reality is that these transactions are permanently recorded. When you buy goods, pay someone, or interact with a business, the involved parties (and anyone monitoring those transactions) can use available tools to connect your addresses across past, present, and future transactions.

Zcash’s use of Zero Knowledge Proofs is widely regarded among cryptographers as a state-of-the-art approach to privacy, and it’s the most advanced method available to solve the privacy problem.

Other Differences to Bitcoin

There are several other differences between Zcash and Bitcoin, ranging from technical parameters to behavioral differences.

Nothing symbolizes this as strong as the existence of a Zcash Network Sustainability Mechanism. The actual name and mechanism details have changed over the years, but not the idea. It is a decentralized reserve of funds created slowly through a small portion of the mining rewards that will be used to fund the protocol’s development and research. The idea is to avoid the “free-rider” problem that public goods experience, where no one is incentivized enough to work on it.

Other protocol differences include shorter block times than Bitcoin (75 seconds vs. 15 minutes) and twice as big blocks. This difference alone is insufficient to enable Zcash to become a network geared towards daily user payments. Still, it does give a smoother user experience in several cases.

The last significant difference I would like to highlight is Zcash’s rate of change. Contrary to a more ossified Bitcoin, Zcash is still developing several bold and ground-breaking initiatives, which will be mentioned later in the document as future cataclysms. Depending on the year you read this article, this section may be heavily outdated — I really hope so.

The Bullish Case

The bullish case for any valuable asset is the culmination of several cataclysms coming together in a period of high adoption and a market opportunity to seize. With several already in motion, Zcash may finally be poised to benefit from this trifecta.

Zcash is Valuable

Zcash is not a science fair project focused on researching mathematical breakthroughs. As we will see, Zcash has the potential to become the best store-of-value in the world. This article is not a theoretical one or privacy propaganda. It is the outline plan for Zcash’s possible tremendous growth over the next few years, with this value being captured by its holders.

In his “The Bullish Case for Bitcoin” essay, Vijay Boyapati expands on the ideal properties a store-of-value should have. He highlighted eight elementary attributes of it:

- It needs to be durable and portable. It must not be perishable or easily destroyed and be easy to transport and store. It should also allow for long-distance trade and protection against theft.

- It needs to be fungible and verifiable. One unit of the object should be interchangeable with another of equal quantity, and it should be easy to identify and verify as authentic. This verification increases confidence and increases trade.

- It needs to be divisible and scarce. The good must be easy to subdivide, allowing frictionless trades of all sizes. Most importantly, naturally, the good can’t be easy to obtain or produce - otherwise, there’s no value in it.

- Finally, it needs to have an established history and be censorship-resistant. The longer society perceives the good as valuable, the greater its appeal as a store of value. Lastly, a new attribute, increasingly important in our modern digital society with pervasive surveillance, is how difficult it is for an external party to prevent the owner of the good from keeping and using it.

Based on these attributes, Comparing Zcash against Bitcoin, Gold, and Fiat allows the reader to unveil its potential as the true digital gold of the 21st century.

| Property | Zcash | Bitcoin | Gold | Fiat |

|---|---|---|---|---|

| Durable | B | B | A+ | C |

| Portable | A+ | A+ | D | B |

| Fungible | A+ | B | A | B |

| Verifiable | A+ | A+ | B | B |

| Divisible | A+ | A+ | C | B |

| Scarce | A+ | A+ | A | F |

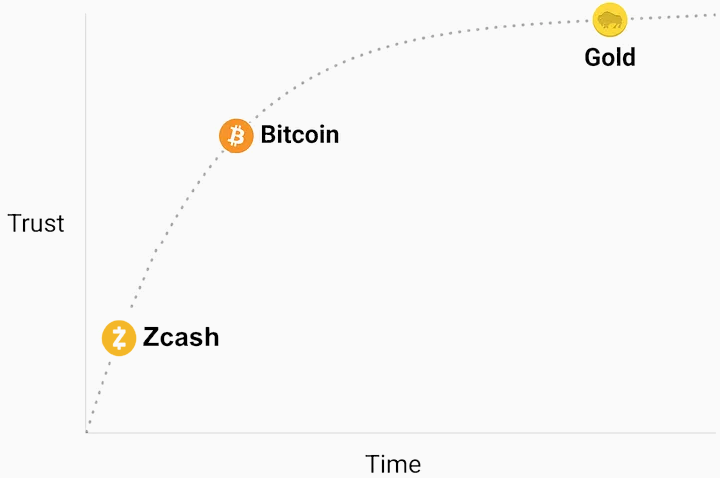

| Established History | D | C | A+ | B |

| Censorship Resistant | A+ | B | C | D |

Expanding on Bitcoin’s properties, Zcash allows users to unlock better fungibility and censorship resistance than every other asset in history.

As of 2025, all major cryptocurrency exchanges backtracked Bitcoin’s origins to catalog its movement. Users are then evaluated on the “cleanness” of their Bitcoins for KYC/AML purposes, promoting the appearance of “Virgin Bitcoins” that go for a premium. These tools are also used by Bitcoin mining pools, which can be forced not to process transactions by their local governments if suspicious, as has happened.

These properties may appear non-consequential to you, but more than 70% of the world’s population lives under effective dictatorships, and the other 30% under surveillance states, be it from social media or their governments. Due to Bitcoin’s transparency, your past transactions or people you have interacted with can be re-evaluated under new social paradigms that ignore historical context and condemn their users without a trial.

Did you buy some medicine 3 years ago? Now, it’s used for drugs, and you are under a federal watchlist. That comment made on X about your president? Your transactions are now monitored and censored. It’s the evolution of witch hunting, ensuring that no past is far enough to be reached. By preserving their privacy, Zcash protects its users from threats that may yet exist.

Where Bitcoin has a head-start on Zcash is its established history. Its launch as the first cryptocurrency allowed for a series of impossible-to-replicate benefits, from coin distribution to unconsequential technology development for the first few years to already being more mature in the world’s eyes. Bitcoin’s incredible work toward institutional acceptance paves the way for Zcash’s legitimacy, as explored further in the article.

Zcash’s Opportunity

Zcash holds a strong position in the expanding offshore market, which is estimated to be worth tens of trillions of dollars. The IMF reports that individuals have about $7 trillion in offshore accounts, while the Tax Justice Network estimates that $21 trillion to $32 trillion is hidden in tax havens. Approximately $4 trillion of US wealth is held offshore, and multinational firms have invested around $12 trillion in empty corporate shells.

Consider MicroStrategy’s public Bitcoin treasury, which invites perpetual scrutiny and front-running by eager speculators. By contrast, Zcash’s inherent privacy minimizes such vulnerabilities, allowing organizations to transact and store wealth away from prying eyes. As more entities embrace crypto and DeFi, Zcash stands primed to become a keystone for privacy-focused services—bolstering its standing as both a secure store of value and a versatile payment currency.

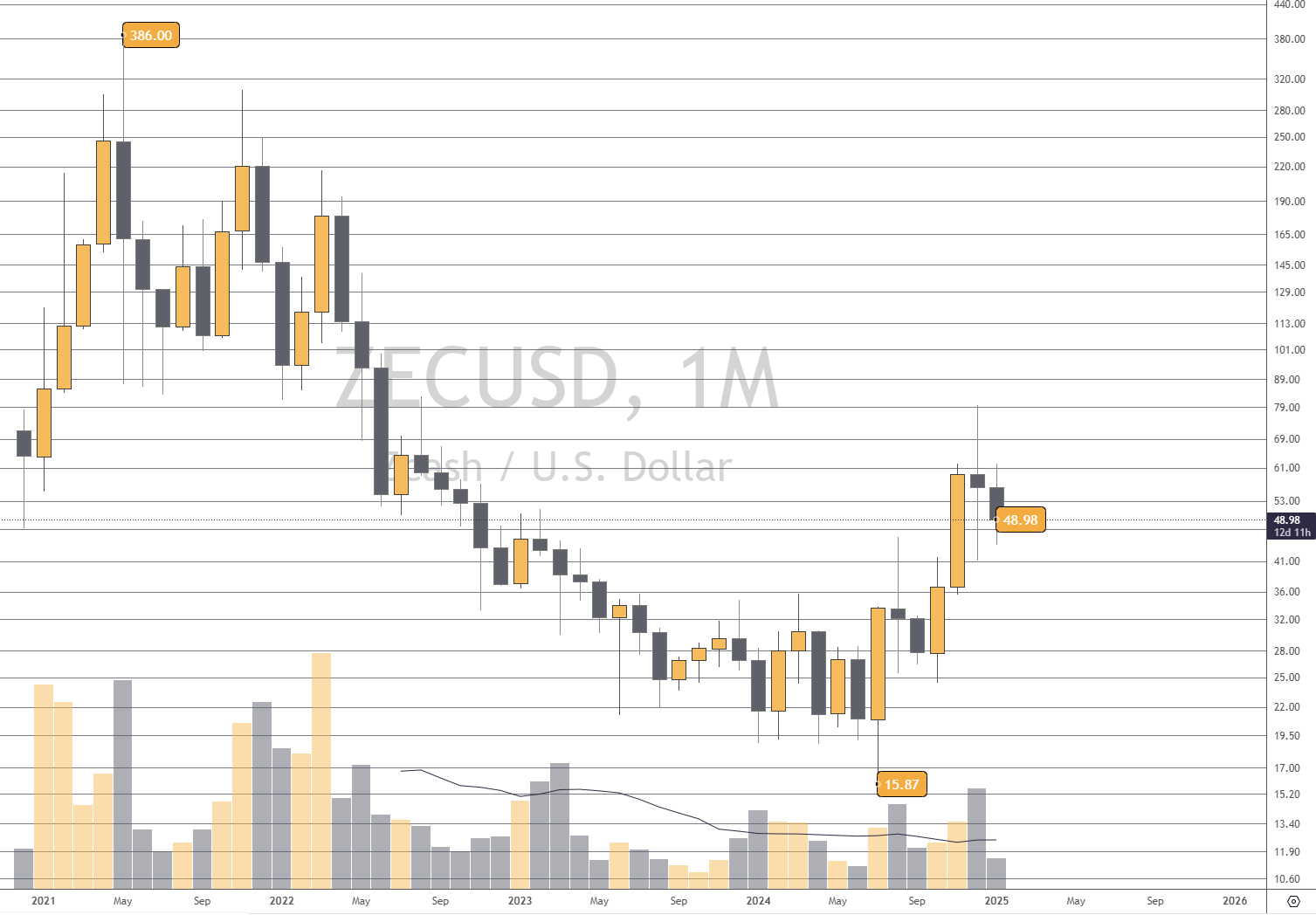

As of 2025, Zcash’s market capitalization stands at $807 Million, a fraction compared to Bitcoin’s $2 Trillion and Gold’s $18 Trillion. The entire cryptocurrency sector is valued at $3.81 Trillion, while offshore accounts tracked by the IMF amount to $7 Trillion. These figures highlight the massive growth potential for Zcash in capturing even small portions of these established markets.

| Scenario (Crypto + Gold + Offshore) | ZEC Market Cap | Implied Price per ZEC (16M) | Gain vs. Current ($51) |

|---|---|---|---|

| 1% | $289B | $18,063 | ~354× |

| 3% | $865B | $54,063 | ~1,060× |

| 5% | $1.44T | $90,063 | ~1,766× |

Even within the cryptocurrency market itself, the opportunity for Zcash is staggering. What started as a technology to decentralize control and empower individuals through financial freedom has grown into a $3.1 trillion industry. Yet remarkably, privacy-focused projects account for less than $7 billion of this total (0.23%). This profound disconnect between crypto’s founding principles of individual sovereignty and the actual capital allocation toward privacy solutions represents both a market inefficiency and an enormous opportunity. Zcash is uniquely positioned to capture this value gap in 2025 and beyond, through its technical maturity, growing institutional acceptance, and the catalysts we’ll explore further in this article.

Where has it been so far?

Zcash was launched in 2016, over eight years ago. Since then, it has achieved incredible world-class technical breakthroughs in its mission to bring privacy payments to the world: encrypted transactions became faster to create (40s to ~5s), and their memory requirements were reduced 100x (3GB to 0.03GB), allowing for a rising ecosystem of mobile wallets.

What Zcash has not achieved, however, is material broader (non-enthusiasts) market recognition or an economic return for its supporters. This article argues why this won’t be the case in the future, but first, we should see why Zcash’s financial performance has historically fallen short until last year.

First, early views within the community, including some from vocal leaders, minimized the importance of price, often stating, “The market is wrong.” While there’s merit in prioritizing long-term innovation over short-term speculation, this perspective overlooked a crucial nuance: price can act as a powerful Schelling point, attracting both attention and resources. The project inadvertently limited broader investment interest by deprioritizing it, creating a feedback loop of diminished sentiment and adoption. Every Bitcoin bull cycle has attracted more users to the network, and Zcash has been unable to replicate this.

Second, the challenges of launching cutting-edge technology were inevitable for an early project like Zcash. The decision to replicate Bitcoin’s emission schedule led to high early emission rates, which weighed on market prices. Technical growing pains—such as longer block times, evolving wallet support, and questions about feature completeness—further compounded skepticism around Zcash’s real-world usability. Governance debates surrounding the network’s funding model also created friction, at times draining the community’s energy and hindering collaboration.

Finally, attempts to resist centralization by discouraging specialized mining hardware (ASICs) came with unintended consequences. Zcash leaned heavily on a hobbyist mining community by favoring GPU mining, whose operators often come with short-term profits and no attachment to the asset. This steady sell pressure weakened the token’s price. Ironically, the effort to avoid centralization backfired on the project’s economics, as large-scale ASIC miners typically have more substantial incentives to hold and protect the assets they’ve invested in. Today, several of Bitcoin’s biggest holders are publicly listed miners.

Together, these factors fed a downward spiral: limited adoption by outside enthusiasts, eroding sentiment, and underwhelming returns for supporters. However, they are circumstantial and not permanent.

This article is being written in 2025, while the Zcash Community has never been more active, and privacy is more important than ever. Signs of change are emerging, suggesting that the future for Zcash is no longer just a possibility but a story in the making.

The Future is Now

From Regulatory Uncertainty to Institutional Adoption

Since Zcash’s creation, crypto assets have fought several battles worldwide to obtain legitimacy. Those have pinnacled in a resounding victory with the newly elected US president, Donald Trump, tying the success of his term to Bitcoin’s price and the recent record-breaking adoption of Bitcoin ETFs and other instruments by Wall Street.

Once at risk of being banned, marginalized, or excluded from the World’s Financial System, Crypto is now being discussed by every wealth advisor in the world, the central bank, and several public companies. Zcash has historically been an amplified risk due to its privacy capabilities, especially at times when all crypto’s liquidity was concentrated on cryptocurrency exchanges, trying to avoid too much regulatory scrutiny.

It’s a continuous humanity achievement that Zcash has not stood still in this regard compared to Bitcoin. The coin has continued to defend its position by supporting the US’s Fourth Amendment and engaging with regulators worldwide, especially in Washington, DC. The recently hosted DC Privacy Summit, an event focused on “the intersection of decentralized networks, advanced cryptography, and the law,” sponsored by Coinbase, counted with multiple lawmakers, White House staff, and industry players. In its agenda, Zcash is mentioned, with presentations from Zooko Wilcox, one of Zcash’s founders, and Josh Swihart, CEO of the Electric Coin Company.

The Electric Coin Company has launched and supported the development of Zcash since 2016, being one of the entities funded by the Zcash Network Sustainability Fund. Paul Brigner, one of the event’s organizers and then Head of Coinbase Insitute, has since re-joined ECC as Vice President of Strategic Alliances, where he is expected to solidify Zcash’s institutional position with the government and companies.

Zcash continues to be listed and supported by Coinbase, the biggest and most connected US-regulated crypto exchange. Its ZEC/USD volume doubled between 2024 H2 and 2023H2. Zcash is also available as a financial instrument through ZCSH, a Grayscale Fund that currently holds 394k (U$22 million) and saw its volume soar over 300% between 2023 and 2024.

Entering Economic Stability and Great Promises Ahead

The volume (and, in turn, interest) rise in Zcash in the second half of 2024 is not by chance. Despite all the expectations we will see here, one of them has been expected since its launch: Zcash’s second halving.

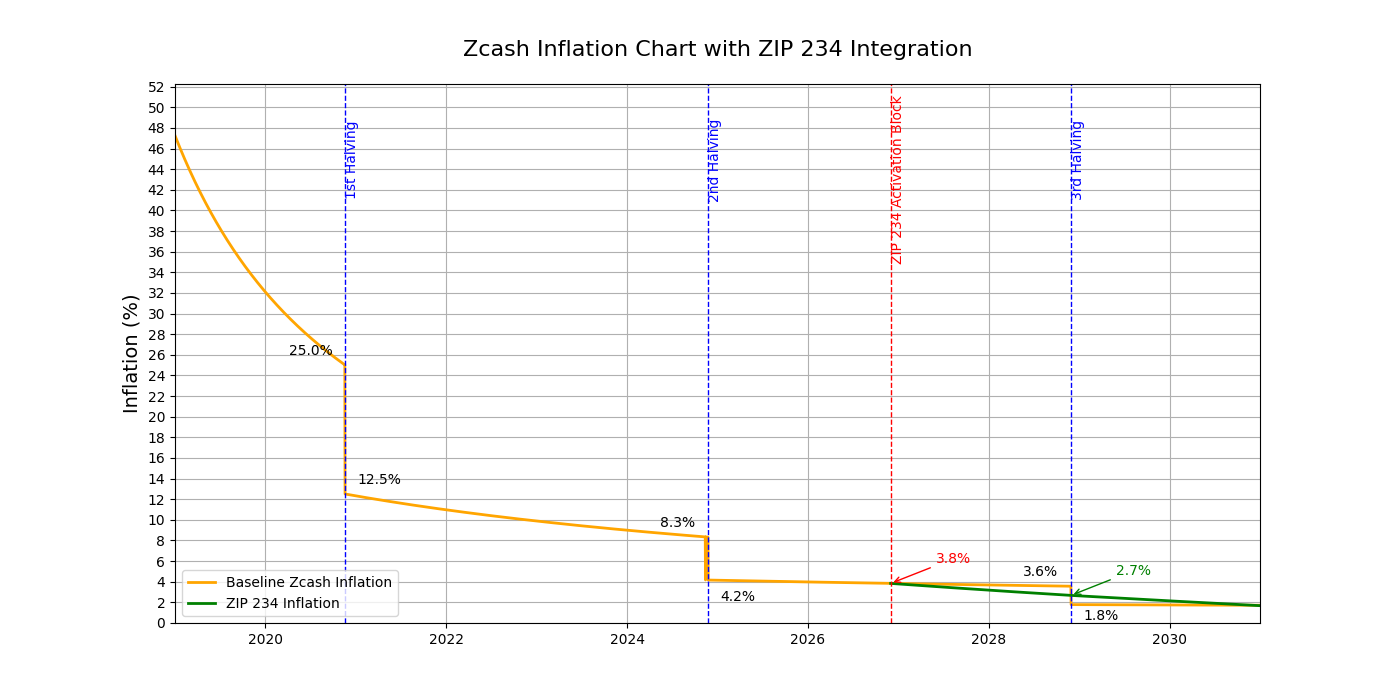

Like Bitcoin, Zcash began its first year with an annualized inflation rate of 48%. During the first halving, after four years of life, the pace of inflation dropped from 25 %/yr to 12.5 %/yr. In November 2024, the second one of these events happened, further lowering the 8.3%/yr to the current 4.2%/yr—the same inflation the US experienced in the previous year.

This significantly lowers the dilution of existing holders and the ability of newly mined coins to impact the network price once they hit the market, as we discussed above. The next one, in 2028, is set to lower Zcash’s emission curve below 2.7%.

This is not the only significant development related to Zcash’s economic model. Shielded Labs, a recently created US company, which boosts the already mentioned Zooko Wilcox as one of its members, has started developing the first implementation of “Crosslink,” a mechanism that would allow transitioning Zcash to a hybrid PoS, before a complete switch. Proof-of-Stake would potentially bring a multitude of benefits, with the two crucial ones to highlight is the reduction of mining costs (and, in turn, the selling pressure that comes with it) and the ability for average Zcash holders to participate in the network consensus and capture the new emissions through staking.

Ecosystem Maturity

The growing pains that have haunted Zcash so far have finally started to show results. In addition to the technical advancements already mentioned, Zcash is now in progress with a wave of user-impacting releases.

After several years of trying to work with older hardware wallet providers (Trezor and Ledger: shame on you) to bring the capability for its users to store ZEC privately, with the convenience and security of these gadgets, Keystone Hardware Wallet jumped ahead in launching this. Now, long-term investors can shield their Zcash holdings without concerns, facilitating usage, storage, and inheritance.

It gets better. The release of this hardware wallet came integrated with Zashi, a new Zcash Mobile wallet developed by ECC, one of the many stable and existing Zcash wallets present across all platforms. The Zashi wallet is also integrated with Coinbase to allow newcomers to purchase Zcash straight from their mobile using ApplePay/GooglePay and Flexa, allowing them to buy physical goods in thousands of merchants across the US, Canada, and El Salvador.

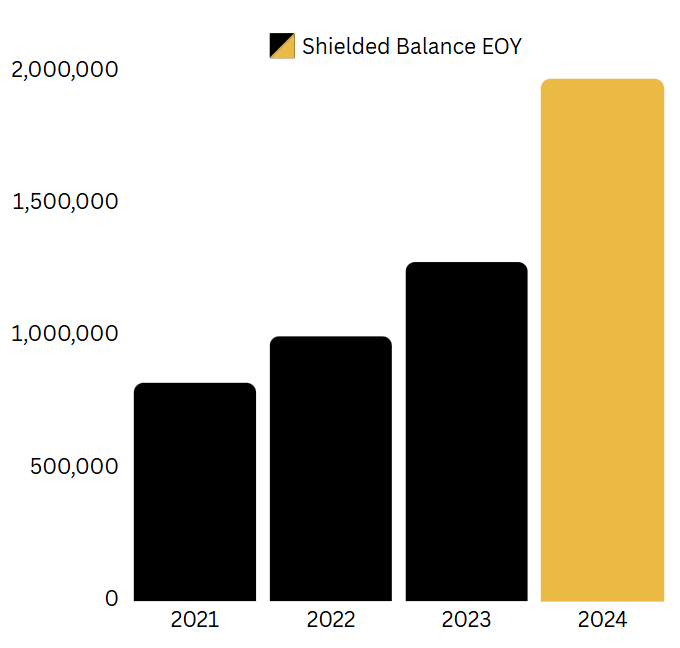

These developments have allowed the expansion of ZECs stored in shielded, private addresses, with an ever-great pace in the last month of 2024 and probably a bigger one once Keystone is in the hands of more people or Ledger and Trezor decide to take their users’ privacy seriously, which is doubtful given their constant data breaches.

The reduction in computation needed to perform encrypted transactions by orders of magnitude since 2016 has also been poised to unblock another wallet frontier: browser wallets. On September 26, 2024, the ChainSafe team successfully performed the world’s first Zcash-shielded transaction from a browser. The WebZjs project is aimed to be production-ready in February.

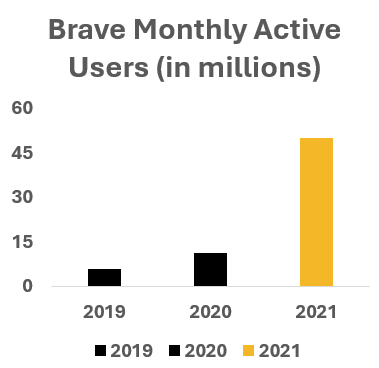

Another significant browser-related project with Zcash is the partnership between the Brave Browser, Electric Coin Co., and Filecoin Foundation to bring private payments and decentralized messaging features to its users while using the InterPlanetary File System (IPFS) for media transmissions. In December 2024, they confirmed that they are working on integrating private Zcash payments within their browser wallet. The latest number of monthly active users from Brave is from 2021, but in May 2022, they shared that Brave Search performed over 420 million queries for that month - over 52 times the query numbers from June 21.

Significant Innovations

We discussed Zcash’s intention to transition from a Proof-of-Work mechanism to a hybrid and finally full Proof-of-Stake. While the full details are still being worked on, and these changes are significant, this project is far from the only one underway that will bring considerable innovations to the protocol.

The upcoming Network Upgrade 7 (NU7) is set to introduce an exciting feature to Zcash: Zcash Shielded Assets (ZSA), which Qedit is currently developing. This upgrade is expected to go live during 3Q2025. With ZSAs, users will be able to create their own private, shielded assets on the Zcash network, much like Ethereum’s ERC-20 tokens.

The development of ZSAs began in 2021 with the vision of paving the way for private DeFi and expanding what Zcash can offer. It aims to provide:

- A permissionless issuance mechanism that enables the creation of native shielded assets, giving users control over minting various asset types, whether fungible or non-fungible, public or private supply.

- A transfer mechanism that allows for the movement of multiple asset types within a single transaction while still maintaining a unified anonymity pool for all assets involved.

- A secure one-way bridge connecting to other blockchains, facilitating the import of existing assets into the Zcash ecosystem.

These innovations lay the groundwork for a comprehensive private DeFi ecosystem on Zcash, which could include private decentralized exchanges, automated market makers, lending platforms, stablecoins, and anonymous credentials for identification. QEDIT has already indicated interest in continuing to build those, and many other parties are sure to appear. Zcash Shielded Assets are an exciting first stepping stone in expanding Zcash’s protocol usefulness to its users, unlocking several use-cases.

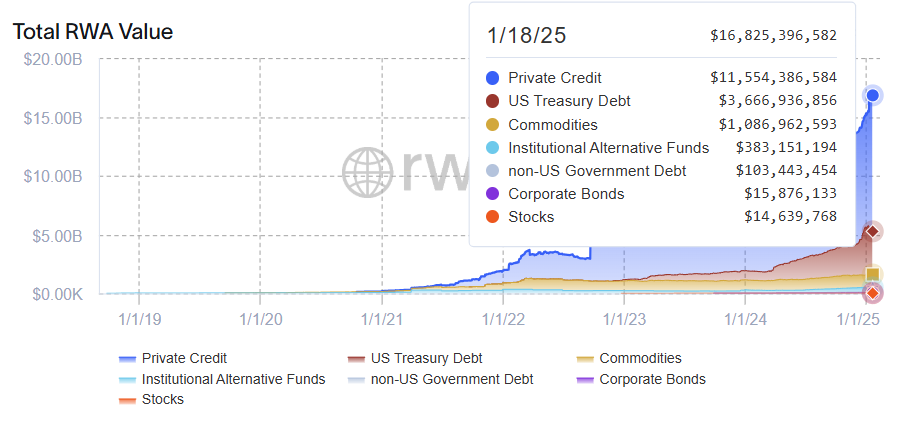

Today, U$16.82 billion in real-world assets (RWAs), excluding stablecoins, are deployed from 111 issuers across different chains. These real-world assets represent the tokenization of tangible assets from the physical world. They include digital securities from capital markets, real estate, art, commodities, private credit, and even stocks. These assets are ideal for leveraging the privacy features of Zcash through Zcash Shielded Assets, allowing everyone to hold extremely valuable assets digitally, securely, and anonymously. ZSAs could unlock trillions in tokenized RWAs through its privacy features.

Decentralized Exchanges, often powered through AMMs, have allowed users to transact between different types of assets (real-world assets, stablecoins, meme coins, utility projects, native tokens) freely and frictionlessly. The top 10 spot DEXes jumped +159% YoY in trading volume during 2024, recording over U$1.8T in volumes - a significant number in all accounts, especially compared to Centralized Exchanges’ U$6T (spot only). The biggest stock exchange in the world by volume, the New York Stock Exchange, sees U$16.8 trillion in annualized trading volume.

These DEXes, however, are, for their large majority, exclusive and confined within their blockchains, forbidding users to transact assets cross-chains. Several projects are leading the change towards that, and one of them is the Maya Protocol, which allows their users to perform native swaps across any integrated chains in a permissionless, on-chain, noncustodial, and secure way. Maya currently performs around 671,020 yearly swaps, shy of U$750 million in volume and over U$30 million in total value locked for instant liquidity.

Maya is set to integrate Zcash within its protocol during the first half of 2025 and has been working with the Zashi team at ECC to have the native swaps integrated into the mobile wallet by launch. This integration will allow easy Zcash access from users of over nine chains, including Bitcoin and Ethereum, from over 5,000 different assets. Equally, this allows Zcash holders access to decentralized finance, like RWAs or stablecoins, from other chains while the ecosystem within Zcash evolves.

Zcash’s Mission

Despite eight years of setbacks and challenges, Zcash and its community remain unyielding, forging the next generation of financial tools to help people everywhere live, transact, and safeguard their wealth in true freedom. They are building a world where our grandchildren will never be forced to flee their homelands in desperation nor see their political views or personal identities cast into the public domain, denying them the fundamental rights they deserve. Never before have so many ground-breaking projects converged on a single mission, and this renewed momentum will catapult Zcash forward, allowing its principles of freedom to reach those who need it most: all of us.

Risks

As the saying goes, nothing in life is certain. Zcash is not immune to risks, and although they are currently much smaller than they were in 2016, they are still present.

The first risk is the rise of central bank stablecoins (CBDCs) as a privacy-preserving alternative to cash and crypto. CBDCs have been a long time coming, and the recent discussions of CBDCs by the US, China, and other major economies have been significant. Central Banks are unlikely to provide the same level of privacy as Zcash, but they could persuade their citizens of the contrary for an indefinite period.

The second risk is that other cryptocurrencies may adopt similar privacy-preserving technologies and gain traction in adoption. This risk has existed since Zcash was launched and is likely to persist. However, this discussion mirrors concerns raised about Bitcoin since its inception regarding its ability to integrate new technologies and fend off competition from other cryptocurrencies. This scenario has not materialized. A similar sentiment was expressed about Ethereum when Solana emerged, yet history has repeated itself in this regard, and both are seeing several innovations happen outside their chains.

The last risk highlighted is an execution solely within Zcash’s control: the inability to catch up with DeFi and foster it within Zcash. This could happen either due to constraints of its UTXO model, since all relevant DeFi existent today are built on account-based models, or because Zcash has been unable to bring stablecoins to its network. Stablecoins are a crucial part of DeFi and are the most used crypto applications in the world. Without them, Zcash would not be able to foster a DeFi ecosystem.

Conclusion

Zcash appears poised for a resurgent chapter as advancements in privacy, regulatory clarity, and technical innovation converge. Its forthcoming transition to hybrid and eventual Proof-of-Stake, the unveiling of Shielded Assets, deeper hardware wallet integration, and growing ecosystem partnerships collectively represent the most substantial momentum Zcash has seen. Zcash will become a serious contender in the crypto sphere and broader financial markets by catering to the global appetite for secure, private digital transactions.

Combined with its tenacious community and unwavering mission to safeguard personal freedom, Zcash is uniquely positioned to seize the opportunities of this new era, by hopefully building it for us.